Canvas - 2188 West 8th Ave

Vancouver, V6K 2A4

Direct Seller Listings – Exclusive to BC Condos and Homes

Sold History

| Date | Address | Bed | Bath | Asking Price | Sold Price | Sqft | $/Sqft | DOM | Strata Fees | Tax | Listed By | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 04/20/2024 | 3 2188 West 8th Ave | 3 | 2 | $1,749,000 ($1,234/sqft) | Login to View | 1417 | Login to View | 6 | $609 | $4,485 in 2023 | Stilhavn Real Estate Services | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 06/15/2023 | 5 2188 West 8th Ave | 3 | 2 | $1,798,000 ($1,248/sqft) | Login to View | 1441 | Login to View | 39 | $609 | $4,139 in 2022 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Avg: | Login to View | 1429 | Login to View | 23 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

AI-Powered Instant Home Evaluation – See Your Property’s True Value

Strata ByLaws

Pets Restrictions

| Dogs Allowed: | Yes |

| Cats Allowed: | Yes |

Amenities

Building Information

| Building Name: | Canvas |

| Building Address: | 2188 8th Ave, Vancouver, V6K 2A4 |

| Levels: | 3 |

| Suites: | 18 |

| Status: | Completed |

| Built: | 2008 |

| Title To Land: | Freehold Strata |

| Building Type: | Strata |

| Strata Plan: | BCS3183 |

| Subarea: | Kitsilano |

| Area: | Vancouver West |

| Board Name: | Real Estate Board Of Greater Vancouver |

| Management: | Tribe Management Inc. |

| Management Phone: | 604-343-2601 |

| Units in Development: | 18 |

| Units in Strata: | 18 |

| Subcategories: | Strata |

| Property Types: | Freehold Strata |

Building Contacts

| Management: |

Tribe Management Inc.

phone: 604-343-2601 email: [email protected] |

Construction Info

| Year Built: | 2008 |

| Levels: | 3 |

| Construction: | Frame - Wood |

| Rain Screen: | Full |

| Roof: | Torch-on |

| Foundation: | Concrete Perimeter |

| Exterior Finish: | Brick |

Maintenance Fee Includes

| Gardening |

| Gas |

| Management |

Description

Canvas at 2188 W 8th Ave, Vancouver, BC V6K 2A4, Canada, Strata Plan Number BCS3183, 3 levels, 18 units in the development, built in 2008. Maintenance fees include gardening, gas and management. Features include bike room and in-suite laundry. Crossroads are Yew Street and West 8th Avenue. This location is in Kitsilano neighborhood in Vancouver.

Walking distance child care services include Montessori Day Care, Kitsilano Day Care Centre, Progressive Learning Centre and Kitsilano Day Care Centre. Nearby parks include Delamont Park, Rosemary Brown Park and Connaught Park. Closest grocery stores are Pranin Health Inc, Natural Program Herbal Laboratories and Body Energy Club. Nearby restaurants include Woodvillage Cafe, Suzette's Deli and Temaki Sushi. Nearby schools include St. Augustine's School, Catholic Churches & Institutions and Elite & Prime Education Canada Inc.

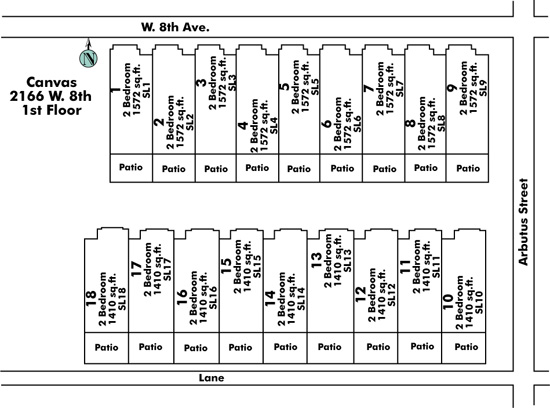

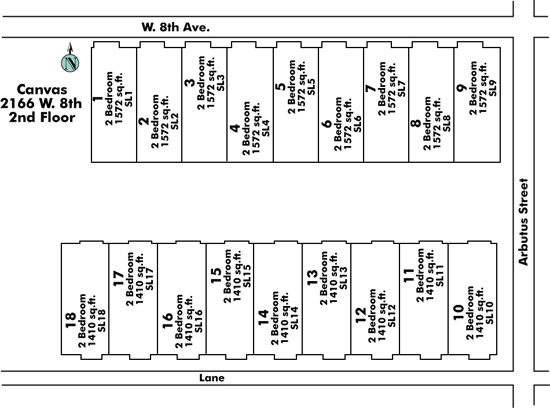

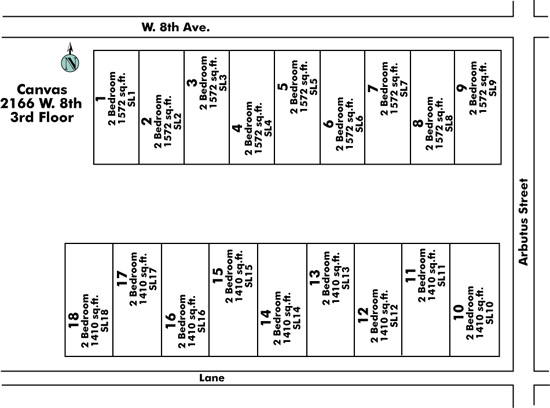

Building Floor Plates

Location

Nearby Buildings

Disclaimer: Listing data is based in whole or in part on data generated by the Real Estate Board of Greater Vancouver and Fraser Valley Real Estate Board which assumes no responsibility for its accuracy. - The advertising on this website is provided on behalf of the BC Condos & Homes Team - Re/Max Crest Realty, 300 - 1195 W Broadway, Vancouver, BC